Sendtips

You know how some folks in some underdeveloped area just can't get a bank account? Well, Sendtips is trying to change that. They're using blockchain, that thing that powers Bitcoin, to let people use crypto for everyday stuff. They're also setting up local agents to help, so it's a bit like a neighborhood bank, but with cryptocurrency.

Project Objective

We're building a simple web app for Sendtips agents. It'll let them easily turn cryptocurrency into cash, and back again, making it super convenient for people without bank accounts to manage their money.

Role

Project Lead, UX/UI Designer

Company

Brandhut Ltd

Year

2022

Who are the unbanked?

The unbanked are people who do not leverage on banks and financial services (whether traditional or digital) for transactions. They primarily conduct transactions with cash. They include?

1. Rural Communities

In many rural communities, banks are just too far away. With limited transportation and poor infrastructure, people feel isolated from the financial world. They're essentially cut off from the services most of us take for granted.

2. Undocumented Immigrants

For people without legal documents, something as simple as opening a bank account becomes incredibly difficult. Banks need specific IDs, and if you don't have them, you're shut out. This means they can't access basic financial tools, making everyday life much harder and often forcing them to use unsafe money practices.

3. Low-Income Individuals

It's hard enough to make ends meet on a low income, but then banks add to the problem with high fees. And if you've had some financial setbacks, they might not even give you a chance. It feels like you're being excluded from the system, and that's why so many low-income individuals are unbanked.

The Unbanked in Nigeria

The Global Findex Database 2021 revealed that about 64 million of Nigeria's 200 million people are still unbanked. The report also showed that 740 million of the world's 1.4 billion unbanked people come from seven economies, including Bangladesh, China, India, Indonesia, Mexico, Nigeria, and Pakistan. However, the report found that global account ownership increased by 50 per cent from 51 per cent in 2011 to 76 per cent in 2021. In Nigeria, the number of people with accounts at regulated institutions increased by 16 per cent to 45 per cent in 2021.

According to the data from Central Bank and EfinA, in 2020, about 36 percent of the Nigerian population is unbanked, and in 2023, we are looking at about 40 million+ excluded people, which is one-quarter of the population.

How will Sendtip bridge the gap?

Sendtips aims to achieve its primary focus of serving the unbanked and promoting financial inclusion through several key strategies:

User Personas

Empathy Map

User Journey

Task Flows

Scenario 1

Amina creates account using USSD

"I want to create a sendtips account using USSD code"

Scenario 2

Amina wants to deposit

Goes to the Sendtips agent to deposit into her account

Scenario 3

Customer wants to withdraw

Goes to the Sendtips agent to withdraw and get cash

Scenario 4

Agent funds wallet

Amina goes to the Sendtip agent for crypto transactions

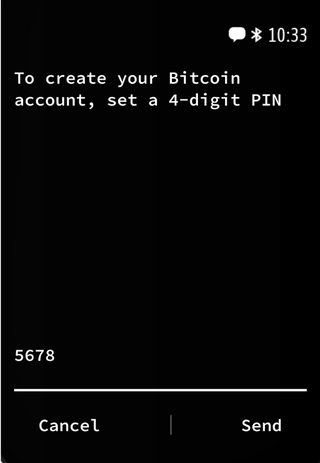

PROTOTYPE 1:

With a few taps, Amina's creating a cryptocurrency account. No internet, no app store, just a simple code. And just like that, she has a crypto address.

Now, she can go to her local Sendtips agent. They'll use that crypto address to help her turn her digital currency into the cash she needs for her family.

PROTOTYPE 2:

Scenerio

-

Amina walks into the Sendtips agent's shop. She wants to add some money to her crypto account.

-

She hands the agent some cash. The agent, using the Sendtips web app on his computer or tablet, enters Amina's unique crypto address.

-

He then does the conversion: he calculates how much cryptocurrency Amina's cash is worth. With a few clicks on the web app, he deposits that amount directly into Amina's crypto account.

-

Later, Amina needs some cash. She goes back to the agent. This time, she wants to withdraw from her crypto account.

-

She gives the agent her crypto address again. The agent uses the web app to initiate a withdrawal from Amina's account."

-

Once the transaction is confirmed, the agent hands Amina the equivalent amount of cash.